expanded child tax credit build back better

The House approval of the Build Back Better Act on Friday paved the way for extending the credit into the 2022 tax return season but Markey other progressive lawmakers and many health officials. The Build Back Better framework will provide monthly payments to the parents of nearly 90 percent of American children for 2022 300 per month.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The November payment of the Child Tax Credit reached 613 million children and kept 38 million children from poverty.

. The West Virginia Center on Budget Policy citing CBPPs analysis warned that not passing the Build Back Better Act would result in a reduced or eliminated child tax credit for 346000 children. The Childrens Defense Fund has a great action hub making it easy to speak up for permanently expanding the Child Tax Credit. If the Senate fails to pass the Build Back Better Act by the end of the year the expanded Child Tax Credit will expire and millions of families will be pushed back into poverty.

Over the last 6 months millions of families have received monthly installments of the CTC including 27 million children who were previously excluded from the full tax credit. The expanded CTC represents the biggest investment in American families and children in a generation. Adding to the deadline pressure for Build Back Better is the warning by Senate finance committee chairman Ron Wyden D-OR that the child tax credit credit needs to be extended by December 28 so.

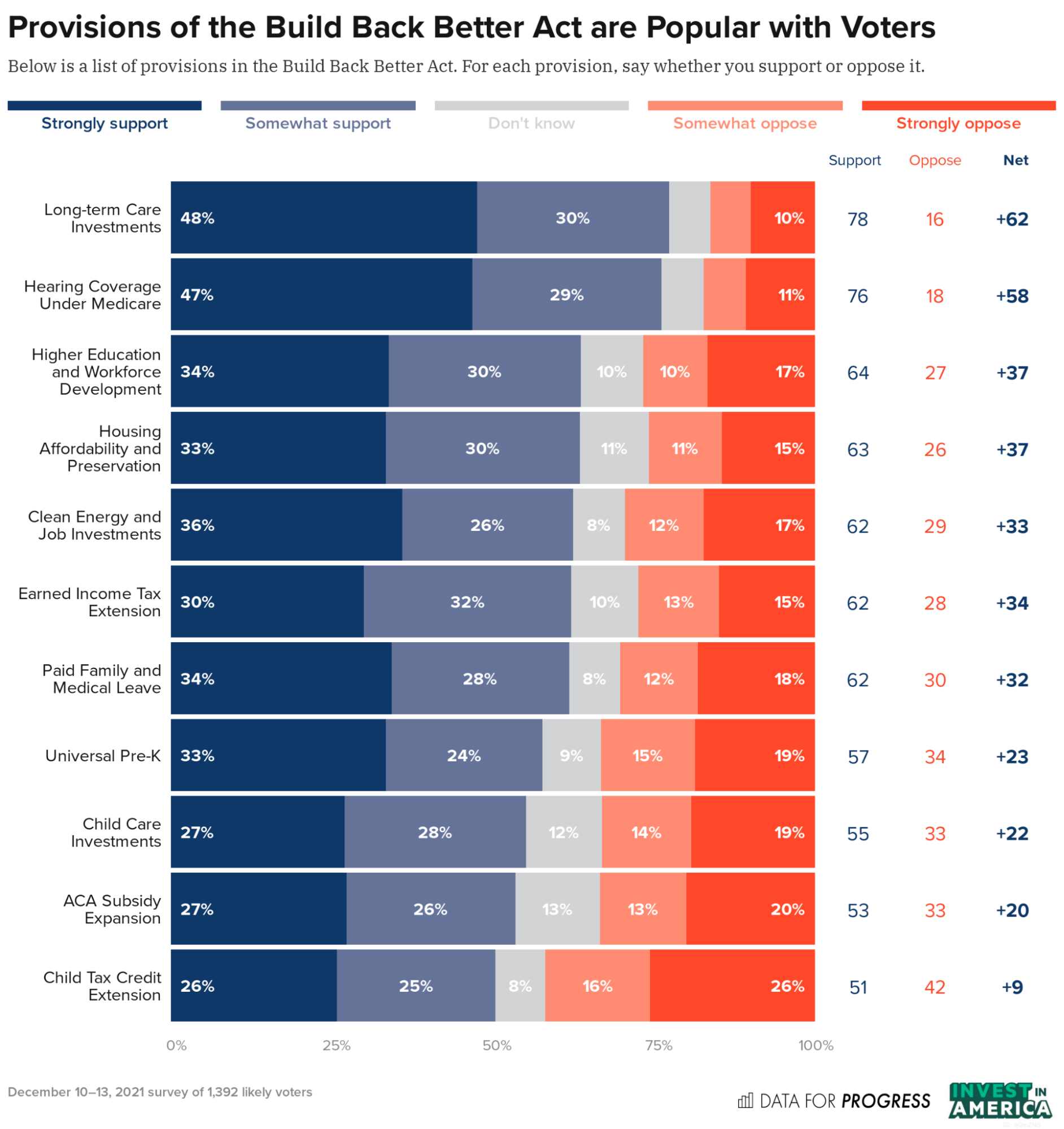

The expanded credit was set to be extended in the Build Back Better Act President Joe Bidens massive public investment bill overhauling health care. The Build Back Better Act would invest roughly 450 billion in lowering the cost of child care and securing universal pre-K for three- and four. Manchin came out against his partys Build Back Better Act leaving the future of the newly installed expanded Child Tax Credit in limbo and a new poll shows voters are divided over whether it.

The Build Back Better framework will provide. The expanded child tax credit was in place for the last seven months of 2021 after it was passed as part of the American Rescue Plan Act. As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP expanded Child Tax Credit CTC as a centerpiece of the legislation.

And it would permanently make the full credit available to children in families with low or no earnings in a year locking in substantial expected reductions in child poverty. The Build Back Better Act extends the expanded Child Tax Credit as well as the expanded Earned Income Tax Credit and the tax credit to help pay for child and dependent care. The House Build Back Better legislation would ensure that families continue to get a significantly expanded Child Tax Credit via monthly payments through 2022.

The expanded CTC represents the biggest investment in American families and children in a generation. The expanded child tax credit in the Build Back Better Act has no means testing so people making 200000 and 400000 would get the same as someone making 70000. The credit got bigger up to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17 an increase from the 2000 families could previously receive for children.

As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP expanded Child Tax Credit CTC as a centerpiece of the legislation. A White House fact sheet laid out more about how the credit will work starting in 2022. Build Back Better Acts Child Tax Credit expansion is expected to reduce child poverty by more than 40 percent compared to the credit without the expansion according to the Center on Budget and Policy Priorities CBPP.

Lower the cost of child care for working families.

The Build Back Better Framework The White House

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

Child Care And Pre K In The Build Back Better Act A Look At The Legislative Text

The Build Back Better Framework The White House

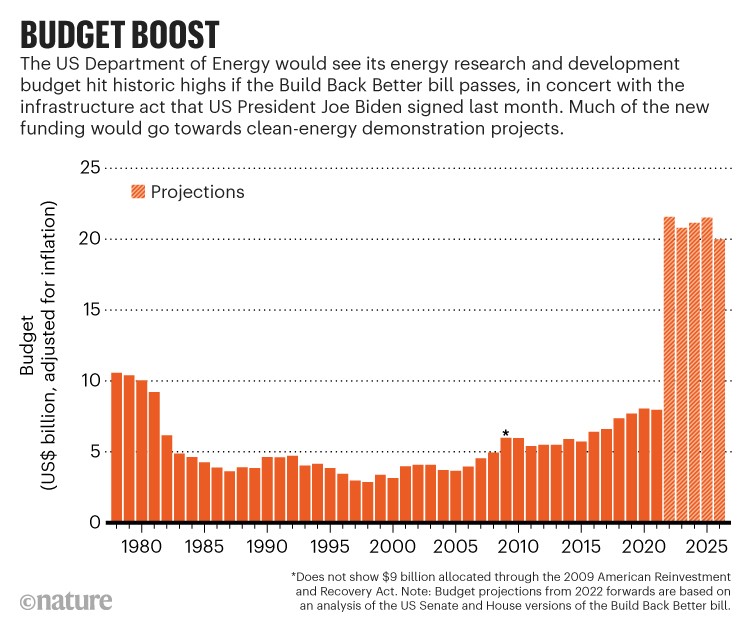

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

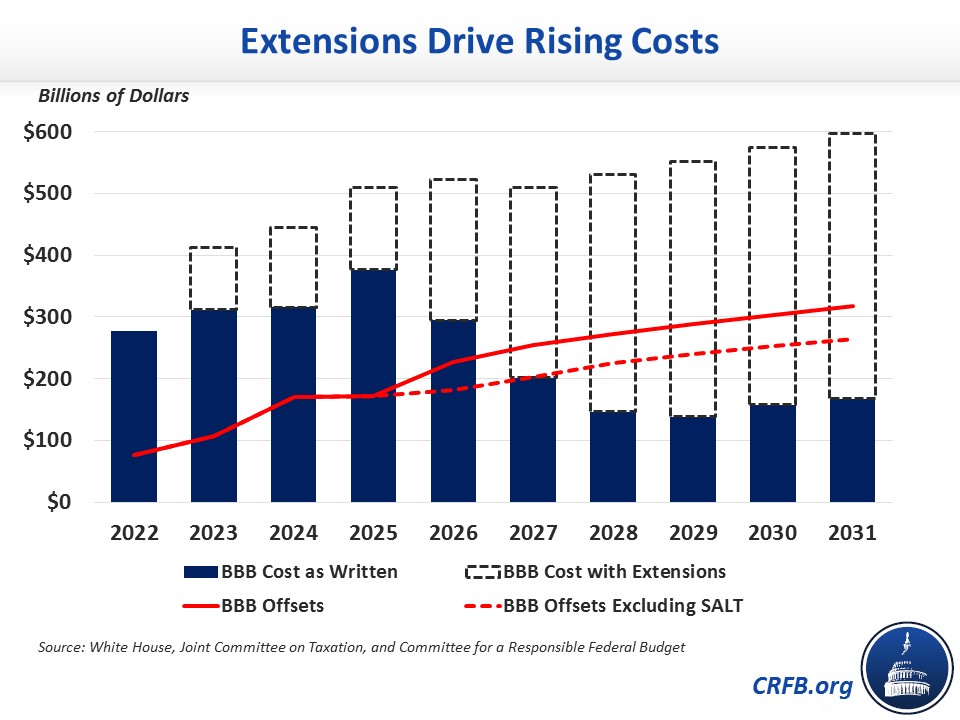

Build Back Better Cost Would Double With Extensions Committee For A Responsible Federal Budget

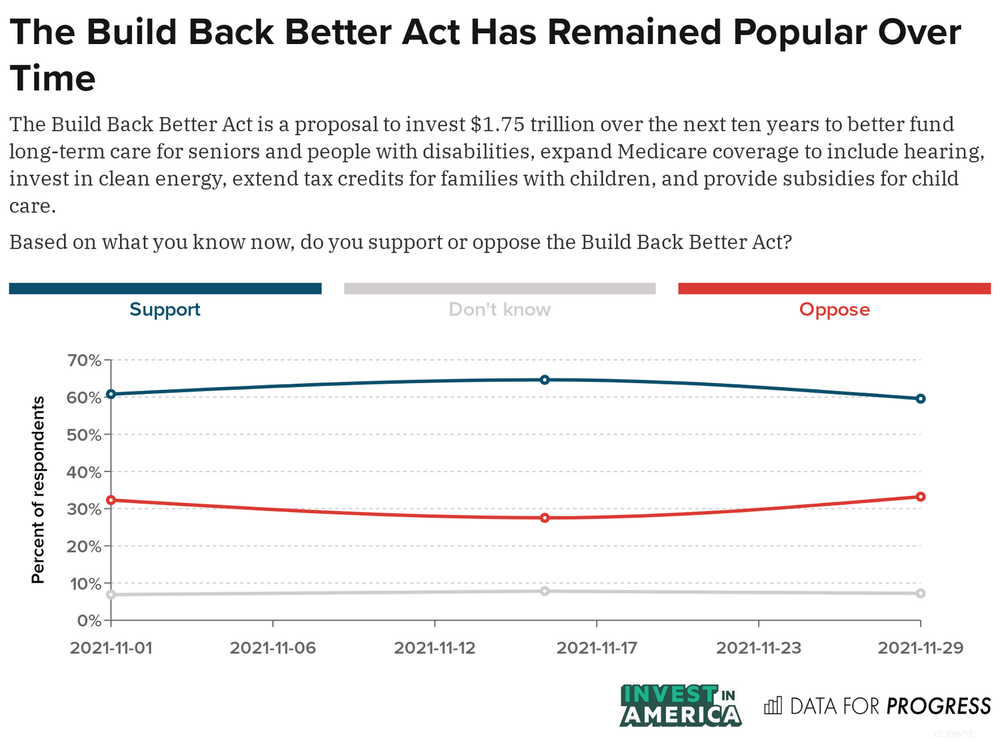

A Recap You Didn T Need Build Back Better Was Popular All Year

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

What Biden S 2 Trillion Spending Bill Could Mean For Climate Change

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

The Build Back Better Framework The White House

Majority Of Voters Support The Build Back Better Act And Want It Passed Now

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers